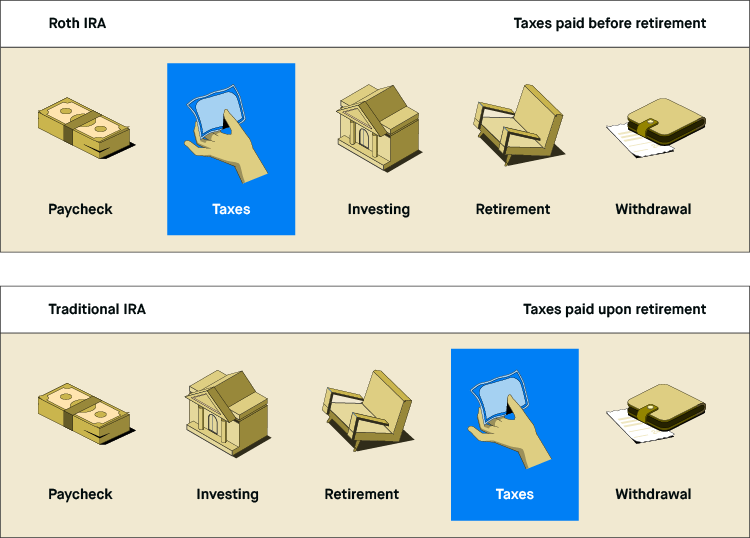

Unlike a traditional ira a roth ira account lets you make contributions with after tax dollars this means you pay income taxes on the money before you move it your roth ira.

Open roth ira robinhood.

Robinhood financial is a relatively new app based broker that allows users to easily trade most stocks and etfs commission free without all the bells and whistles that come with the more traditional online brokers.

A roth ira is a type of retirement account that allows people to save money invest it and reap certain tax benefits.

For 2020 the maximum contribution to a roth ira is 6 000 per year but if you re 50 or older that increases to 7 000 per year.

How to start a roth ira.

2 000 in cash and or securities.

Btw i am a college student with little disposable income to invest 200 a month.

While there s a roth ira maximum contribution amount there s no minimum according to irs rules.

There is a bit of a.

In 2020 as long as your gross income is less than 124 000 for single filers and 196 000 for married couples filing jointly you can contribute the maximum amount into a roth ira.

Open roth ira through robinhood.

How much can you put into a roth ira.

Ira accounts are not offered at robinhood.

Let s say you want to start saving money for retirement.

You fund your account and choose investments.

You do your research and decide that a traditional ira is right for you.

Open ally invest account what is robinhood.

As of 2019 you can contribute up to 6 000 a year or 7 000 a year if you re over 50 and can deduct part or all of that amount on your income taxes depending on your income.

Robinhood minimum initial deposit to open roth ira traditional ira simple ira or sep ira.

While this means you ll pay taxes now contributing to a roth ira can make a big difference in the future.

The good news is that the irs doesn t require a minimum amount to open a roth ira.

Robinhood minimum investment to open brokerage account.

Robinhood minimum balance requirement for brokerage.

I currently trade using the robinhood app but is there any way possible to open a roth ira account for tax purposes.

Robinhood minimum amount to open brokerage margin account.

With a roth ira you pay taxes on your income before you make a contribution and you won t owe additional taxes if you withdraw the money according to federal rules.