Basics of residential energy credits several renewable energy tax credits have been extended under the bipartisan budget act of 2018 explains jacob dayan ceo and co founder of community tax.

Oregon energy credits 2018.

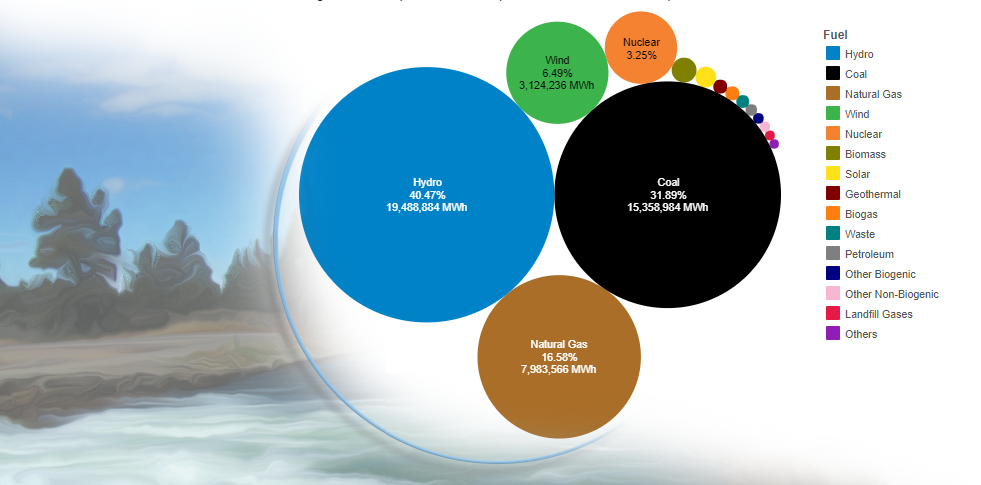

Oregon residential energy tax credit homeowners who installed solar panels prior to december 31 2017 were eligible for a credit on your oregon state taxes to help recover expenses.

The residential energy credits are.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

They ll be in effect until 2021 with a gradual step down in credit value each year.

Thank you to the nearly 600 000 oregonians who participated in the program since 1977.

The oregon department of energy s residential energy tax credit program ended in 2017.

X x x 852 oregon low income community jobs initiative new markets.

Rachel wray oregon department of energy.

Questions about the energy incentive program eip contact.

We do monitor developments at the state legislature to understand potential impacts on programs and services available for utility customers including the availability of energy efficiency and solar tax credits which often factor into customers.

Making energy efficient upgrades to your home is a great way to save money and energy while improving comfort.

Claim the credits by filing form 5695 with your tax return.

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

X x x 859.

X x x 855 oregon production investment fund contributions.

The oregon department of energy or odoe was charged with its m anagement.

Right now many of us are spending more time at home and are likely seeing energy bills go up as a result.

2018 energy incentives program eip tax credits oregon transparency skip to main content skip to footer links.

The credit was valued at 1 70 per watt w of installed capacity up to 6 000.

X x x 857 renewable energy development fund contributions.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

Energy trust of oregon does not take positions on legislation or engage in political issues.

The business energy tax credit program otherwise known as betc was created to incentivize the pursuit of energy efficiency and renewable energy among oregon businesses.

After two decades of operation.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.